Trade the Basic Commodities of Life

Commodities are basic to our daily life, which makes the commodity futures markets among the largest, with huge trading volumes. Binary options and spreads give you a different way to trade commodities—with limited risk and a lower cost of entry. You can never be stopped out or get a margin call.

We offer binaries on these metals, energies and agricultural products:

Metal: gold, silver, copper

Energy: crude oil and natural gas

Agricultural: corn and soybeans

Trade These Markets with Crude Oil and Spreads

Metals

Contracts in gold, silver, and copper based on COMEX/NYMEX® futures.

Energy

Trade crude oil and natural gas with prices based on NYMEX® futures.

Agricultural

Corn and soybean contracts based on CBOT® futures prices.

Make Volatility Your Ally

In volatile markets, traditional trading can be risky. Our binary options and spreads help manage risk by letting you define your maximum loss before entry.

Even if prices spike against your position, you won’t be stopped out. You maintain control, with the ability to exit trades before expiration to lock in profits or limit losses.

Small Opening Balance, Big Opportunity

You don’t need $25,000 to start. We offer low deposit entry points, designed for traders looking to learn and grow while managing risk effectively.

Many prefer capped profit in exchange for capped risk—our approach supports that philosophy with flexible and secure spread contracts.

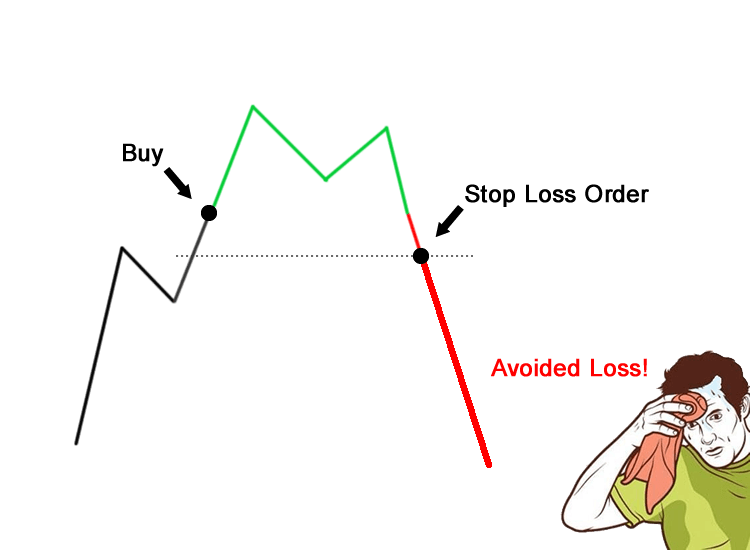

Stop-Loss Protection, Without Getting Stopped Out

Traditional stop-loss orders carry the risk of slippage or margin calls. With our spreads, risk is known up front and never exceeds your chosen limit.

Even if markets move sharply, you remain in the trade—never stopped out. That gives you the staying power to wait out temporary volatility and exit when it suits your strategy.

Trend-Follower? You'll Love Our Spreads

Ride the part of the trend where you see the best opportunity—without the stress of unlimited downside. Our spreads come with built-in floors and ceilings for risk control.

This structure appeals to disciplined, long-term investors who want to stay in the game even during price swings—perfect for oil, gold, and more.